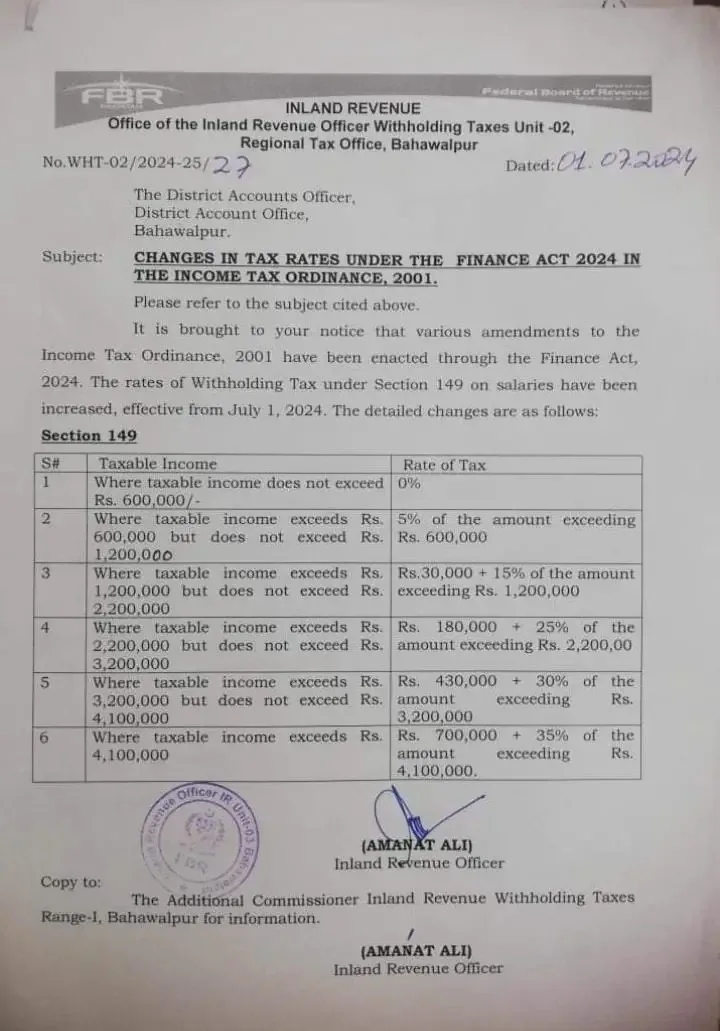

Notification Regarding Changes in Income Tax Rates 2024-25 for Salaried Persons

The Inland Revenue Office, Withholding Taxes Unit – 02, Regional Tax Officer, Bahawalpur, has issued a notification concerning the revised income tax rates for the fiscal year 2024-25 for salaried individuals. These changes have been made under the Finance Act 2024, amending the Income Tax Ordinance, 2001. The new rates for withholding tax under Section 149 on salaries are effective from July 1, 2024.

Revised Income Tax Rates under Section 149

| Sr No | Taxable Income | Rate of Tax |

|---|---|---|

| 1 | Where taxable income does not exceed Rs. 600,000 | 0% |

| 2 | Where taxable income exceeds Rs 600,000 but does not exceed Rs 1,200,000 | 5% of the amount exceeding Rs 600,000 |

| 3 | Where taxable income exceeds Rs 1,200,000 but does not exceed Rs 2,200,000 | Rs 30,000 + 15% of the amount exceeding Rs 1,200,000 |

| 4 | Where taxable income exceeds Rs 2,200,000 but does not exceed Rs 3,200,000 | Rs 180,000 + 25% of the amount exceeding Rs 2,200,000 |

| 5 | Where taxable income exceeds Rs 3,200,000 but does not exceed Rs 4,100,000 | Rs 430,000 + 30% of the amount exceeding Rs 3,200,000 |

| 6 | Where taxable income exceeds Rs 4,100,000 | Rs 700,000 + 35% of the amount exceeding Rs 4,100,000 |

The revised tax rates indicate an increase in the amount of tax payable by government employees compared to the previous year. For example, an employee who was previously paying a monthly income tax of Rs 7,500 will now be required to pay approximately Rs 10,000 per month.

Copy to the following:

- The Additional Commissioner Inland Revenue Withholding Taxes Range-I, Bahawalpur for information.