The Latest Salary and Pension Increase News Updates: Budget 2024-25 for Employees and Pensioners

Outline

- Introduction

- Overview of Budget 2024-25 salary and pension updates

- Significance of the changes

- Proposed Salary Increase for Government Employees

- Details of the 10% to 15% proposed salary increase

- Government’s commitment to the proposal

- PPPP Delegation’s Proposal

- Meeting with the Prime Minister

- Request for a 20% to 25% salary increase

- Prime Minister’s response and considerations

- Potential Salary Increase Scenarios

- Initial 10% proposal

- Possible increases to 12.5% or 15% due to pressure

- Implications for government employees

- Monetization of Vehicles

- Current monetization amounts for BPS-20 to BPS-22

- Proposed increase in monetization from 20% to 25%

- Tax on Pension

- Introduction of taxable pension slabs

- Proposed threshold for tax exemption

- Pension Reforms

- Ceasing multiple pensions

- Other potential reforms

- Retirement Age Proposals

- Proposal to increase retirement age to 62 or 65 years

- Potential impact on employees

- Calculation of Pension

- Average of the last 36 months of basic pay

- Change in pension increase basis

- Commute Amount Reduction

- Proposal to decrease commute amount from 35% to 25%

- Potential effects on pensioners

- Employment After Retirement

- Rules for pensioners taking another government job

- Choosing only one pension

- Financial Status and Government Decisions

- Government’s financial considerations

- Balancing employee needs with budget constraints

- Comparison with Previous Budgets

- Salary and pension changes in past budgets

- Trends and patterns

- Public Reaction and Feedback

- Employee and pensioner reactions

- Feedback from public and unions

- Conclusion

- Summary of key changes

- Final thoughts on the budget proposals

- FAQs

- Common questions and answers about the proposed changes

The Latest Salary and Pension Increase News Updates: Budget 2024-25 for Employees and Pensioners

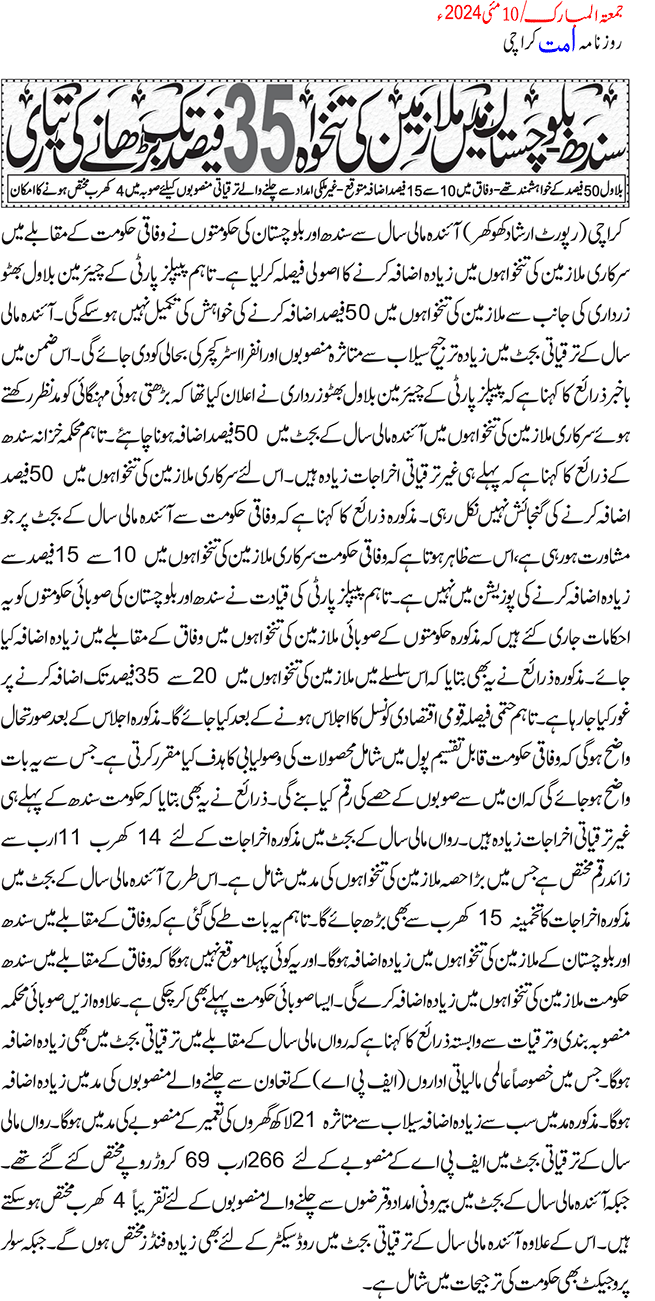

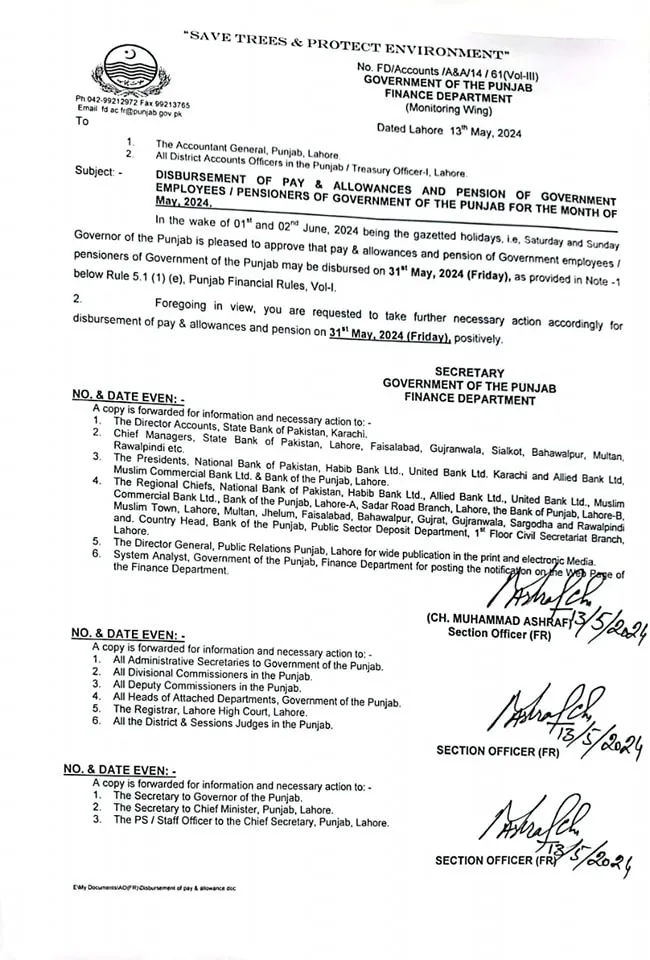

In the eagerly anticipated Budget 2024-25, there are significant updates concerning salary and pension increases for government employees and pensioners. These proposed changes are set to impact a wide range of individuals, aiming to address financial stability and provide a more sustainable future for public sector workers.

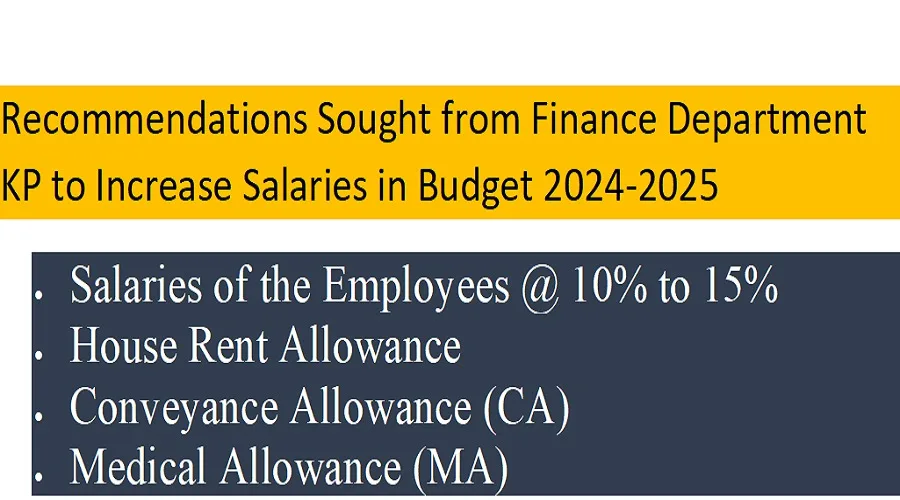

Proposed Salary Increase for Government Employees

As part of the Budget 2024-25, a key highlight is the proposed 10% to 15% salary increase for government employees. This proposal reflects the government’s acknowledgment of the rising cost of living and the need to support its workforce adequately.

PPPP Delegation’s Proposal

In a recent development, the Pakistan Peoples Party Parliamentarians (PPPP) delegation met with the Prime Minister, urging an even more substantial increase. They proposed a 20% to 25% hike in salaries, citing inflation and the need for competitive compensation. The Prime Minister showed a positive inclination towards this suggestion, considering the nation’s financial status.

Potential Salary Increase Scenarios

Initially, the government proposed a 10% increase. However, due to mounting pressure and negotiations, there’s a likelihood this could be adjusted to 12.5% or even 15%. Such adjustments aim to balance employee satisfaction with fiscal responsibility.

Monetization of Vehicles

Currently, government employees in BPS-20 to BPS-22 receive vehicle monetization allowances as follows:

- BPS-20: Rs. 67,000 per month

- BPS-21: Rs. 77,000 per month

- BPS-22: Rs. 87,000 per month

The proposed budget suggests increasing this monetization rate from 20% to 25%, further enhancing the benefits for higher-grade officials.

Tax on Pension

A noteworthy change in the upcoming budget is the introduction of taxable pension slabs. The new proposal suggests that pensions below Rs. 100,000 will be exempt from taxes, providing relief to lower-income pensioners.

Pension Reforms

Pension reforms are a major focus in Budget 2024-25. The government is considering ceasing the provision of multiple pensions to streamline benefits and reduce redundancy. Additionally, there are various other reforms under discussion to ensure a fair and equitable pension system.

Retirement Age Proposals

One of the significant proposals is to increase the retirement age to 62 or 65 years. This change aims to extend the working life of employees, which can benefit both the workforce and the government by maintaining experienced personnel for longer.

Calculation of Pension

Another proposed reform is to calculate pensions based on the average of the last 36 months of basic pay, rather than the final salary. This method aims to provide a more accurate reflection of an employee’s earnings and contributions over time.

Commute Amount Reduction

The commute amount, currently at 35%, might be reduced to 25% as per the new proposals. This change could impact the take-home pension of retirees but is seen as a necessary adjustment to balance the budget.

Employment After Retirement

For pensioners who secure another government job post-retirement, the new rules will require them to choose only one pension. This reform aims to prevent double-dipping and ensure a fair distribution of pension funds.

Financial Status and Government Decisions

The government is walking a tightrope, balancing the need to increase salaries and pensions with the overall financial health of the nation. These decisions are being made with careful consideration of the current economic landscape and future projections.

Comparison with Previous Budgets

When comparing these changes to previous budgets, it becomes evident that there is a consistent trend towards increasing compensation for government employees. However, the extent and nature of these increases vary based on the economic conditions and political pressures of the time.

Public Reaction and Feedback

Public reaction to these proposed changes has been mixed. While many government employees and pensioners welcome the increases, there are concerns about the adequacy of these measures in the face of rising living costs. Feedback from unions and public forums highlights the need for ongoing dialogue and adjustments.

Conclusion

In summary, Salary and Pension Increase the Budget 2024-25 brings forth several significant proposals aimed at improving the financial well-being of government employees and pensioners. From salary increases and vehicle monetization to pension reforms and tax adjustments, these changes are poised to make a considerable impact. As the government balances these updates with fiscal responsibility, the true effects will unfold in the coming months.

FAQs

1. What is the proposed salary increase for government employees in Budget 2024-25? The proposed salary increase ranges from 10% to 15%, with potential adjustments to 12.5% or 15% due to additional pressures.

2. How will the new pension reforms affect retirees? Salary and Pension Increase The pension reforms include ceasing multiple pensions, calculating pensions based on the last 36 months’ average basic pay, and other measures aimed at ensuring a fair distribution of benefits.

3. What changes are proposed for the retirement age? The government is considering increasing the retirement age to either 62 or 65 years, extending the working life of government employees.

4. Will there be any changes to the tax on pensions? Yes, the proposed budget introduces taxable pension slabs, with pensions below Rs. 100,000 being exempt from taxes.

5. How will vehicle monetization allowances change? The budget proposes increasing vehicle monetization rates for BPS-20 to BPS-22 employees from 20% to 25%, enhancing their benefits.